A health savings account (HSA) is a tax-favored personal savings account which works with your consumer-driven high deductible health plan. HSA dollars can be used to pay for qualified medical expenses such as deductibles, copays, dental, and vision care. For a complete list of qualified medical expenses, see Publication 502.

HSA Company Funding

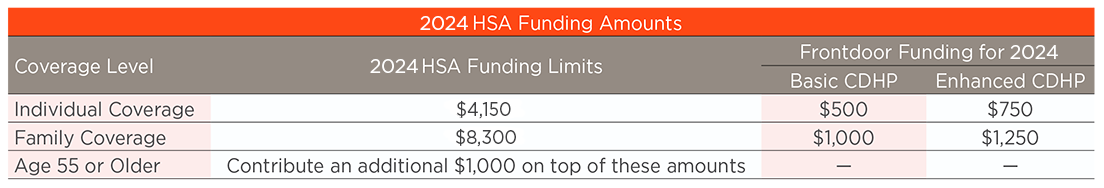

If you enroll in one of the CDHP medical plans, Frontdoor will contribute to your HSA (see the chart above). To receive the Frontdoor funding, you must elect the HSA even if you choose not to contribute your own funds; otherwise, you will not receive the company funding. Frontdoor deposits 50% at the beginning of the plan year, with the remainder of the funds deposited per pay period throughout the plan year. Company funding is included in your annual contribution limit. If you are hired on or after January 1, 2024, you will receive a prorated amount of the company funding your first year.

HSA Major Benefits

HSA Triple Tax Savings