Life and Long-term Disability insurance is provided through Prudential. Frontdoor provides Basic Life Insurance and Short-term Disability insurance at no cost to you.

Basic Life Insurance

The company automatically provides you with a life insurance benefit of 1.5 times your annual salary rounded to the nearest multiple of $1,000 (up to $300,000) at no cost to you. You are responsible for paying the taxes on any amount of the company life insurance that is in excess of $50,000. This is called imputed income. Imputed income is added to your annual salary for reporting purposes. If you do not actively enroll in optional life insurance or long-term disability, you will automatically continue in the prior year’s plan for the next year as long as Frontdoor is offering the same plans and you are not informed otherwise.

Supplemental Life Insurance

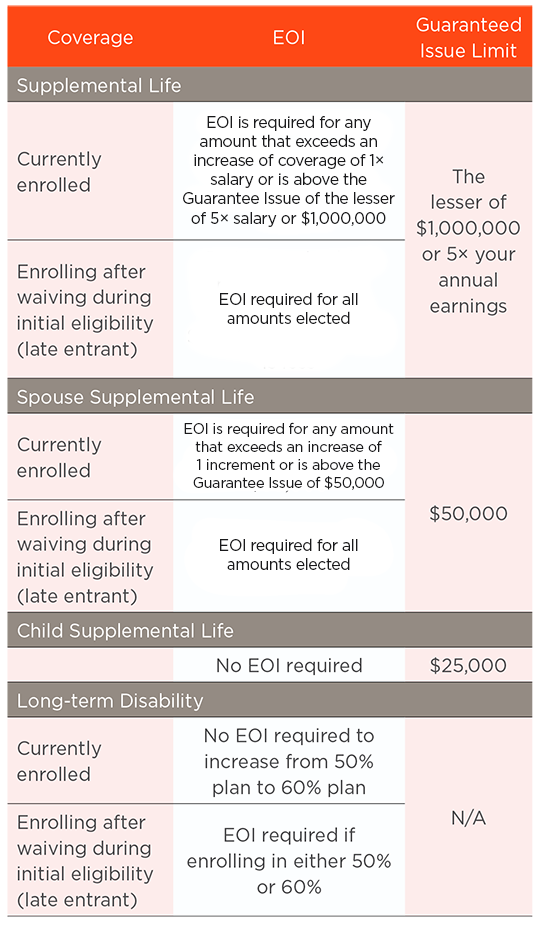

You are eligible to purchase additional life insurance in increments of 1, 2, 3, 4, or 5 times your annual salary up to a maximum benefit of $2 million combined with your basic life coverage amount. Employees currently enrolled for supplemental employee term life coverage may elect to increase the amount of insurance during an annual enrollment period. Any amount that exceeds an increase of coverage of one times salary or is above the guarantee issue of the lesser of five times salary or $1,000,000 requires Evidence of Insurability (EOI). Current approved amounts will carry over to the following year.

Spouse and Dependent Supplemental Life Insurance

If you elect voluntary life coverage for yourself, you can also elect supplemental life coverage for your spouse or domestic partner for one of the following coverage amounts: $15,000, $25,000, $50,000, $75,000, or $100,000. Dependent life coverage is available in coverage levels of $2,000, $5,000, $10,000, $15,000, or $25,000. No spouse, domestic partner, or dependent can have a coverage amount that is more than 100% of your basic and supplemental life insurance combined.

Please see the EOI chart at the bottom of this page for more information on the guaranteed issue amount.

Current approved amounts will carry over to the following year.

If you and your spouse or domestic partner both work for Frontdoor, you can be covered as an associate or as a spouse or domestic partner, but not both.

Life Insurance Beneficiaries

You designate a beneficiary or beneficiaries during the enrollment process. You may change your beneficiaries throughout the plan year in Workday. Your life insurance benefits (company paid and supplemental) will be paid to the beneficiaries you designate. You are automatically the beneficiary for the spouse and dependent life insurance you elect. Be sure your beneficiaries are listed in Workday.

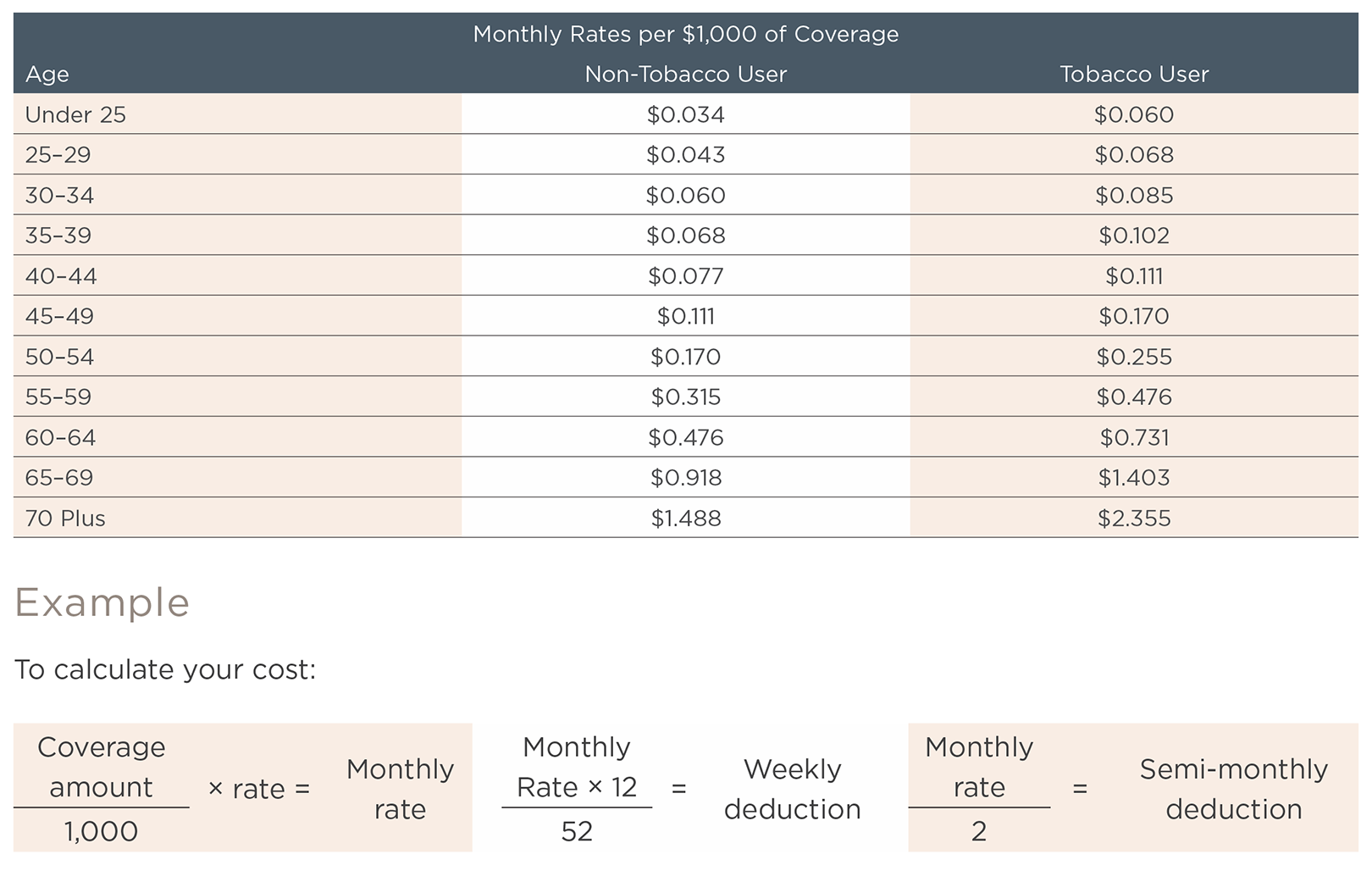

2024 Supplemental Life Insurance Rates

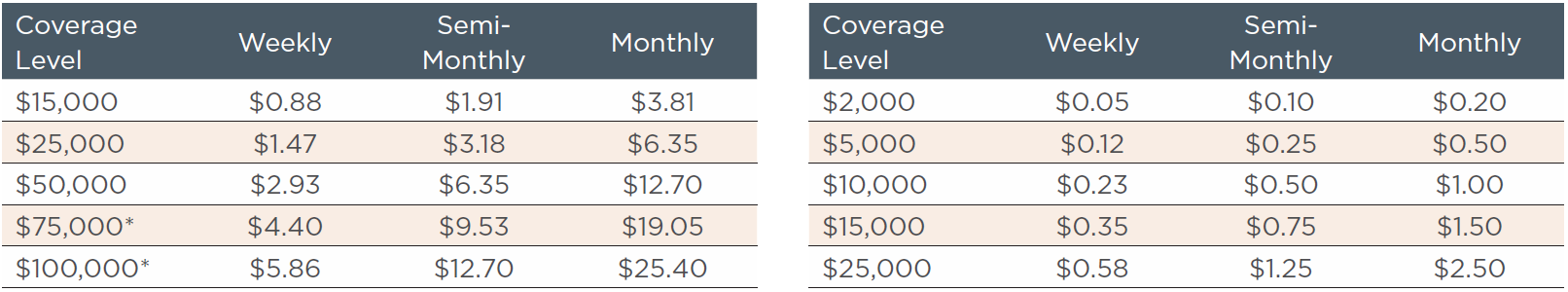

2024 Dependent Life Insurance Rates – Spouse

2024 Dependent Life Insurance Rates – Child(ren)

* If you are currently enrolled, Evidence of Insurability (EOI) is required for any amount that exceeds an increase of 1 increment or is above the Guarantee Issue amount of $50,000. For late entrant (enrolling after waiving during initial eligibility), EOI is required for all amounts elected. Elected amounts in excess of the plan guarantee issue limit is subject to EOI. Please note that there is no EOI required for supplemental dependent child life coverage at any level.

Short-term Disability (STD)

The company provides a benefit payment through a Short-term Disability (STD) plan to financially protect you in case of illness or injury. You will automatically be enrolled after six months of service. The amount of your STD benefit depends on your length of service. If you have been with Frontdoor for six months to five years, the STD benefit is 60% of your annual earnings. If you have been with our company for five or more years, the STD benefit is 80% of your earnings. There is a seven-day waiting period for illnesses, but coverage for an accident and the birth of a child will begin immediately.

Long-term Disability (LTD)

The company provides Long-term Disability (LTD) insurance on a voluntary basis to offer you financial assistance in the event you are unable to work for an extended period of time. You are eligible for the plan after six months of service. The plan covers 50% or 60% of your pre-disability earnings depending on which coverage option you choose. The maximum LTD benefit will not exceed $15,000 per month.

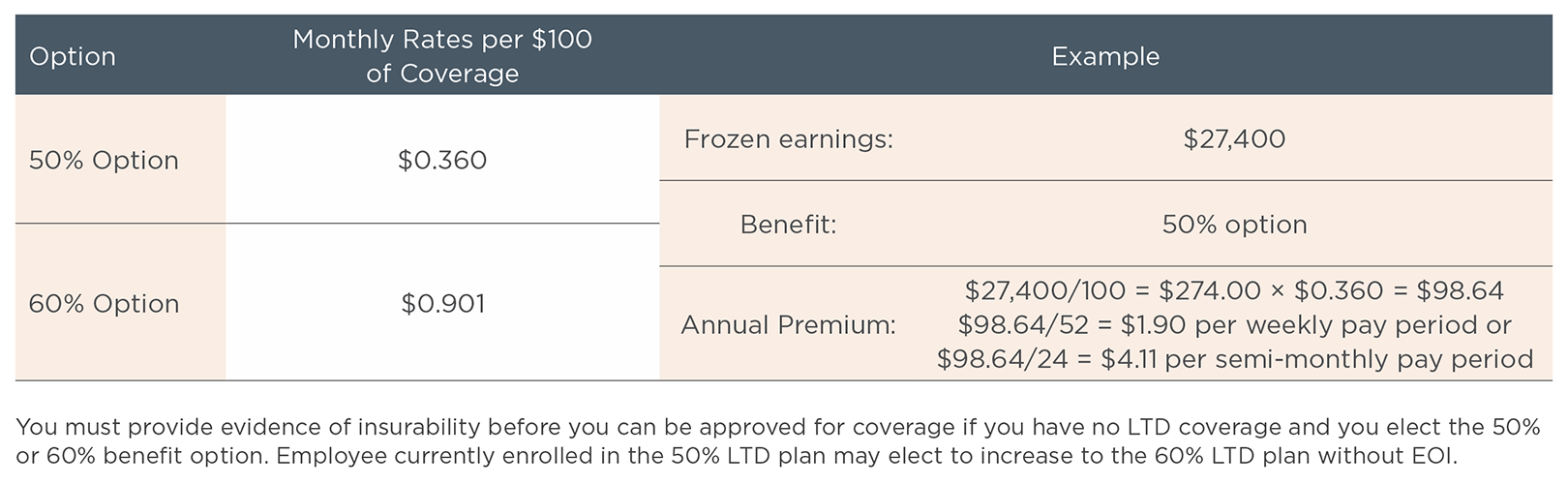

2024 Long-Term Disability Insurance rates

Evidence of Insurability

Evidence of Insurability (EOI) is an application process that requires you to provide information about your health to Prudential. You will complete the EOI application on the Prudential website, which you can access in single-sign-on in Workday. Based on this information, Prudential will approve or deny the level of coverage you elected. Each plan has a Guaranteed Issue (GI) limit, which is a factor in deciding whether EOI is required. Here are the rules (in the chart) for each type of coverage Frontdoor offers.

Annual Earnings

Your earnings are determined on September 1 of the current year for the following plan year. They include nondiscretionary bonuses and commissions that you have actually received but do not include overtime, discretionary bonuses, discretionary income, or any other extra income in other categories you receive from Frontdoor.