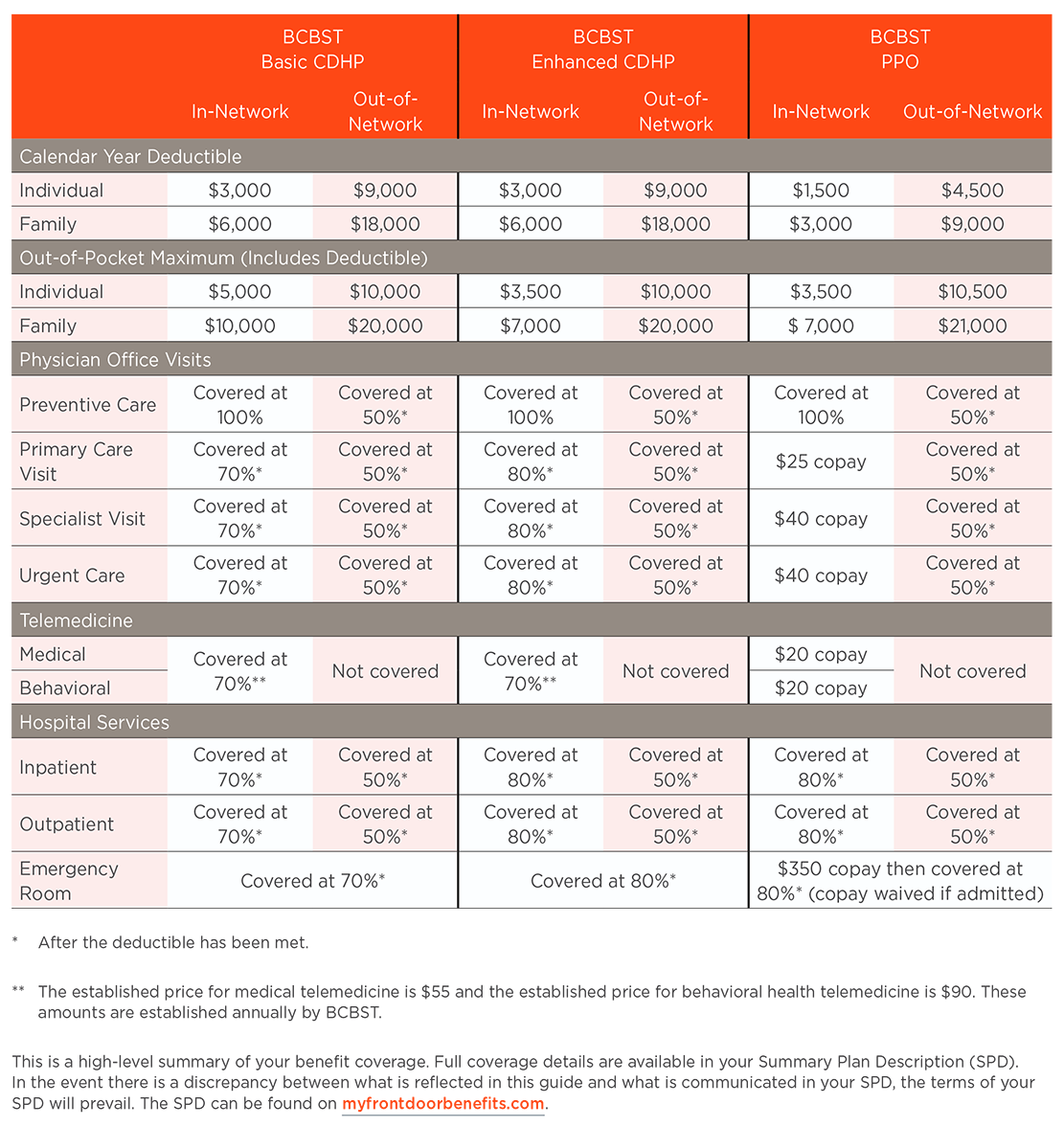

Our company partners with BlueCross BlueShield of Tennessee (BCBSTN) to offer medical insurance and Express Scripts for prescription drug insurance.

Plan Highlights

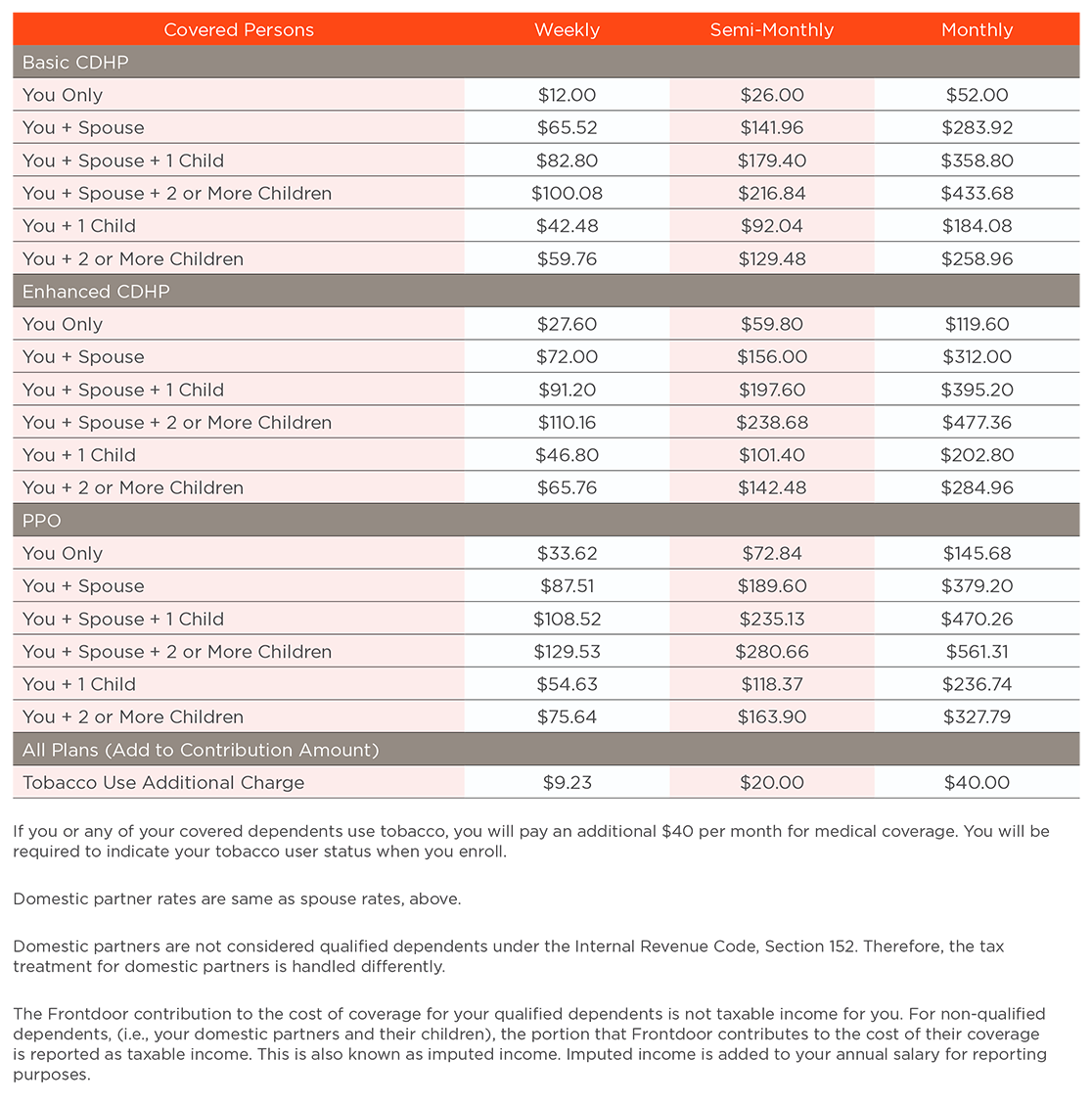

We offer three healthcare plans so that you can choose the level and type of plan that is best for you and your family. When you choose in-network providers, you benefit from our negotiated discounts with BlueCross BlueShield of Tennessee and Express Scripts.

Member Site

Visit bcbst.com to find:

Visit express-scripts.com/Frontdoor to find:

Stay in the Network

A network is a group of providers your plan contracts with at discounted rates. You will almost always pay less when you receive care in-network.

If you choose to see an out-of-network provider, you will pay more out of pocket due to a higher deductible and co-insurance requirements. You also may be balance billed, which means you will be responsible for charges above BCBSTN’s reimbursement amount.

How to Search for a Participating Provider

- Go to bcbst.com

- Click on find a doctor

- Under All Networks, from the dropdown menu, choose “Blue Network P” for providers in the Tennessee area; choose “Blue Card PPO” for providers outside Tennessee area.

Important Insurance Terms

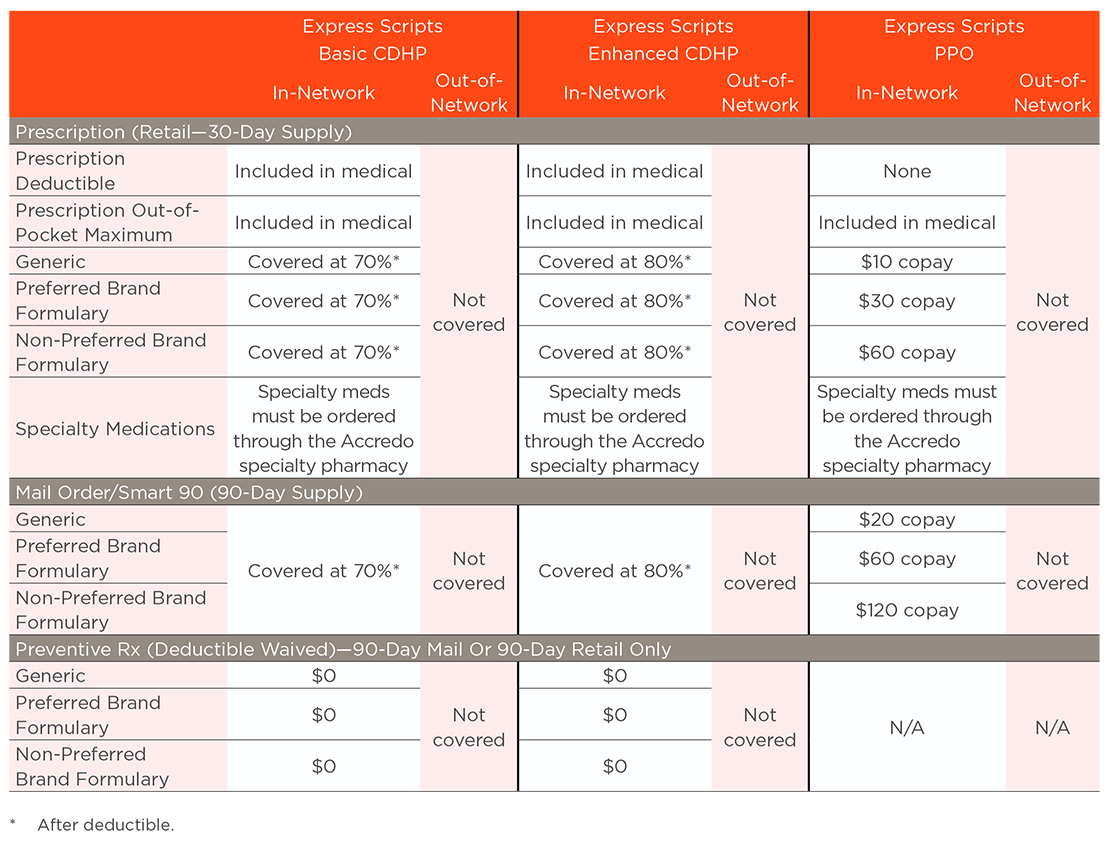

Prescription Smart90

Our plans require you to fill your long-term medication with a 90-day supply rather than a 30-day supply. You have the option to fill your 90-day supply through mail order or an in-network retail pharmacy (such as Kroger, Costco, and Walmart). The copay will be the same. For Basic and Enhanced CDHP medical plans, all prescription expenses are subject to the medical deductible with the exception of preventive prescriptions.

Please keep in mind, CVS and Walgreens are out-of-network. If you have questions, call 855-283-7451 or visit express-scripts.com.

The prescription drug plan covers the first two courtesy fills for 30-day supply for maintenance drugs through an in-network or out-of-network pharmacy.

Additional Documents

Express Scripts

Register with Express Scripts – Member Guide

Automatic Prescription Refills

Find a Pharmacy Member Guide

Find a Pharmacy Member Guide (Spanish)

Price a Medication – Pharmacy Specific

Price a Medication – Pharmacy Compare

Price a Medication – Pharmacy Compare (Spanish)

Getting Started with Home Delivery

Pharmacy Formulary

2022 Express Scripts National Preferred Formulary

View the Benefits Plan Documents page for additional medical plan documents